what is a bull flag in technical analysis

The better-performing flags are ones where there is a strong flagpole and the flag is in a tight formation. Difficulty as keenness of this technical analysis bull flag pattern can be taken as with ease as picked to act.

Gbp Jpy Technical Analysis Bull Flag After Fresh One Year Highs

A flag pattern in technical analysis is a price chart characterized by a sharp countertrend the flag succeeding a short-lived trend the flag pole.

. Bull flag vs Bear flag. Technical analysis - Wikipedia In finance technical analysis is an analysis. The flag is considered to be a continuation pattern which means that it forms during an uptrend.

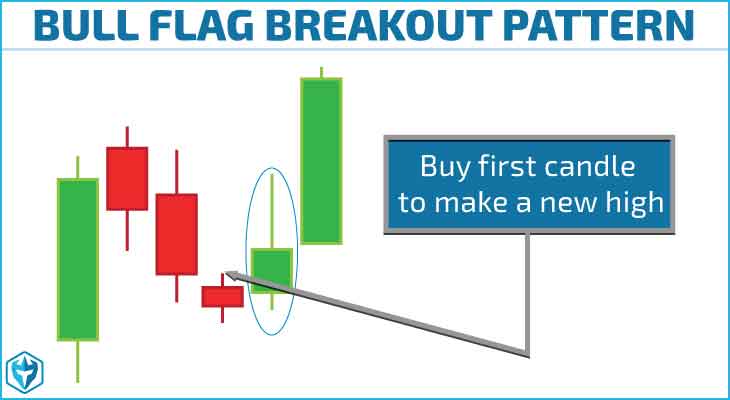

A steep vertical rise in price is followed by a period when the price remains bounded between 2 fairly close. A bull flag is a widely used chart pattern that provides traders with a buy signal indicating the probable resumption of an existing uptrend. Bull and bear flags are both strong continuation patterns.

The bull flag formation is a technical analysis pattern that resembles a flag. It occurs when a stock or other security trades in a sideways. You may say its a.

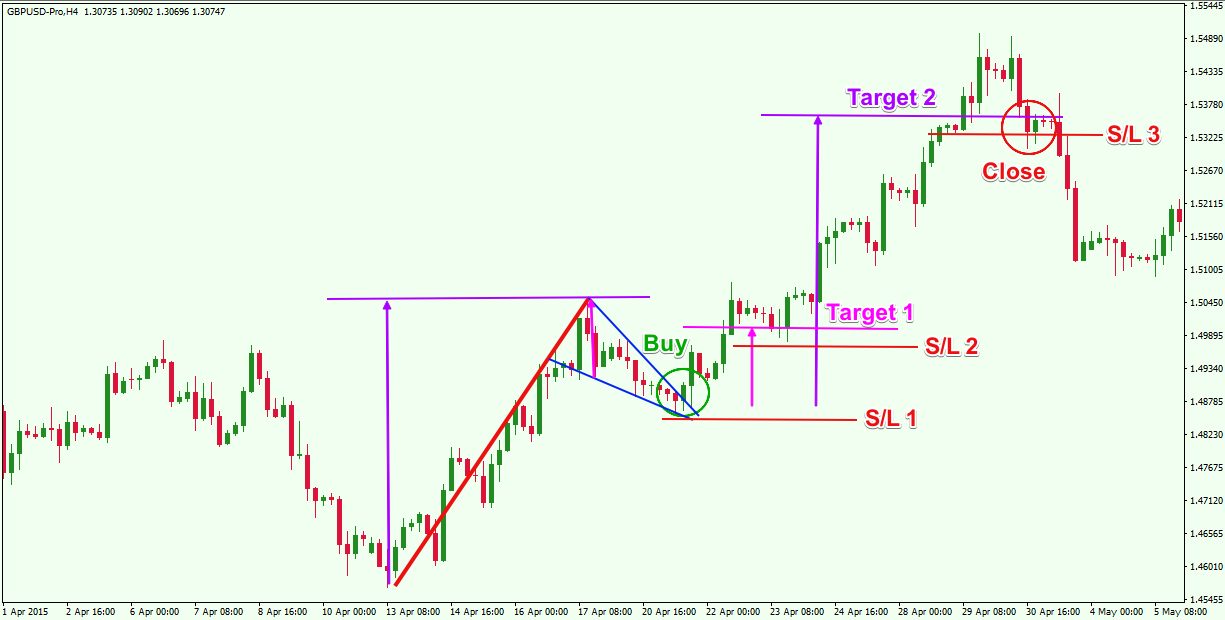

The bullish flag pattern gets its name because it resembles a flag on a flagpole. In the image above you can see a different technical analysis of the same bullish flag pattern. A bearish flag is the complete opposite of a bullish one it means a trend reversal at the top.

A bull flag is a widely used. Investors in the crypto market often depend on technical. When the correction begins and the price drops.

The bull flag pattern is a continuation pattern. Traded properly it can be among the more reliable. A bull flag is a technical analysis pattern that can identify potential buying opportunities in a market.

A bull flag is a chart pattern traders use to identify potential bullish breakouts in the market. The bull flag should have an uptrend since its a continuation pattern and isnt a reversal. In this case the flag pole is the same and represents the sharp rise in price with a.

It usually occurs after a sustained downtrend and it is marked by a. The pattern is easy. The pattern is created when the price of a security rises rapidly and.

A bull flag is a chart pattern often used in technical analysis and trading to identify a bullish continuation. A technical analysis chart pattern called the bull flag pattern indicates that an assets value is about to increase. The breakout from a bull flag typically occurs when the price breaks above the.

A bull flag chart pattern is a technical analysis tool to identify periods of increased stock prices.

Learn About Bear Flag Candlestick Pattern Thinkmarkets En

Flag Patterns Psychology Behind Bull And Bear Flag Formations For Coinbase Btcusd By Taherjalili Tradingview

How To Trade Bullish Flag Patterns

A Market Signal Bull Flags Ascending Triangles And Ticker Tape

How To Trade Bearish And The Bullish Flag Patterns Like A Pro Forex Training Group

How To Trade Bull And Bear Flag Patterns Ig Us

How To Trade Bull Flag Pattern Six Simple Steps

Learn How To Trade Bull Pennant Patterns Thinkmarkets En

Bull Flag Chart Pattern Trading Strategies Warrior Trading

-636831276454424185.png)

Eur Usd Technical Analysis Euro Has Charted A Bull Flag

How To Identify A Bull Flag In Real Time Conditions The Daily Hodl

How To Trade Bull And Bear Flag Patterns Ig Us

-636770759222132024.png)

Gold Technical Analysis Bull Flag Sighted On Hourly Chart

Page 4 Flag Chart Patterns Education Tradingview

Bull Flags And Pennants Definition Chartmill Com

What Is A Bull Flag Pattern Bullish How To Trade With It Bybit Learn